Proud sponsors of

Optimize Human Capital Spend, Faster

Identify inefficiencies, model org changes, and forecast financial savings

Optimize Human Capital Spend, Faster

Identify inefficiencies, model org changes, and forecast financial savings

Proud sponsors of

Drive cost optimization and value creation

- Reduce human capital costs by identifying inefficiencies across portfolio companies

- Streamline operations by eliminating duplication and reallocating talent effectively

- Model organizational changes to simulate cost savings and value creation

- Optimize headcount allocation for M&A, restructuring, and workforce planning

- Benchmark portfolio performance to ensure alignment with strategic financial goals

More about us

Fill the form for a comprehensive overview of our platform.

People costs are a blind spot

Private equity firms oversee 20-100 portfolio companies, yet workforce costs, headcount structures, and inefficiencies remain difficult to track. Firms rely on manual data consolidation and static models, slowing down cost optimization and value creation.

Assessing workforce costs across a portfolio is slow and fragmened

Optimizing workforce spend lacks strategic precision

Scaling insights across a portfolio is nearly impossible

Optimize people costs across your portfolio in days, not months

Eliminate the delays of manual workforce analysis and make faster, data-driven decisions. Get insights on restructuring a company, planning M&A integrations, or optimizing headcount costs, instantly.

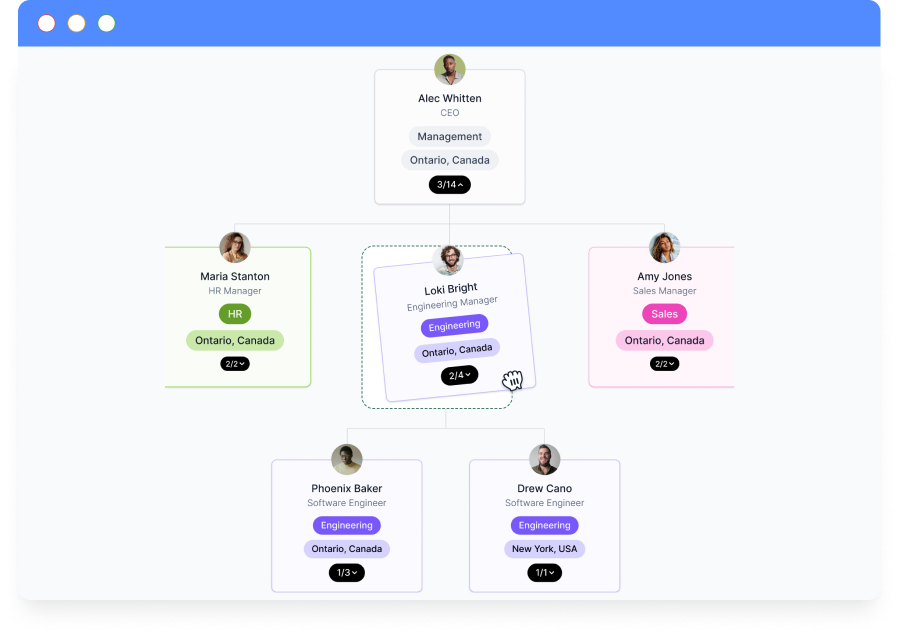

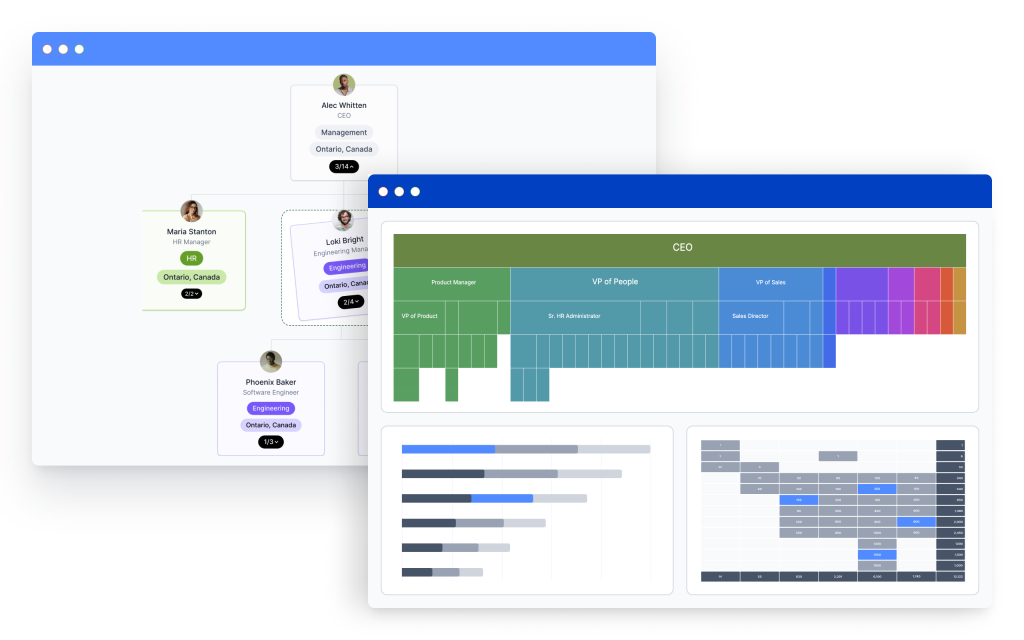

Analyze your entire portfolio 10x faster

Get a real-time view of workforce costs, headcount distribution, and inefficiencies across all portfolio companies.

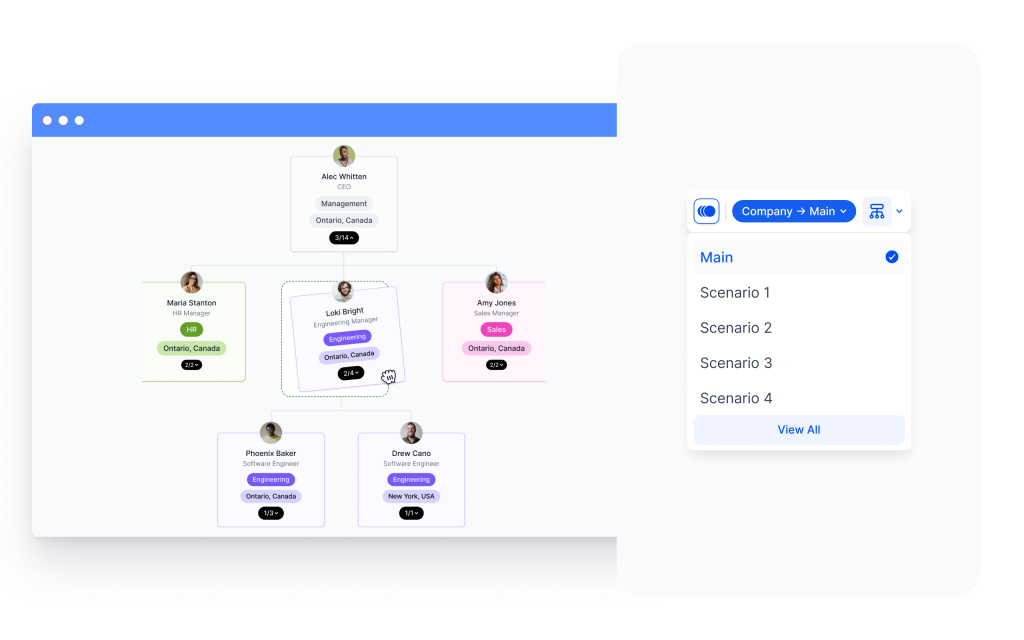

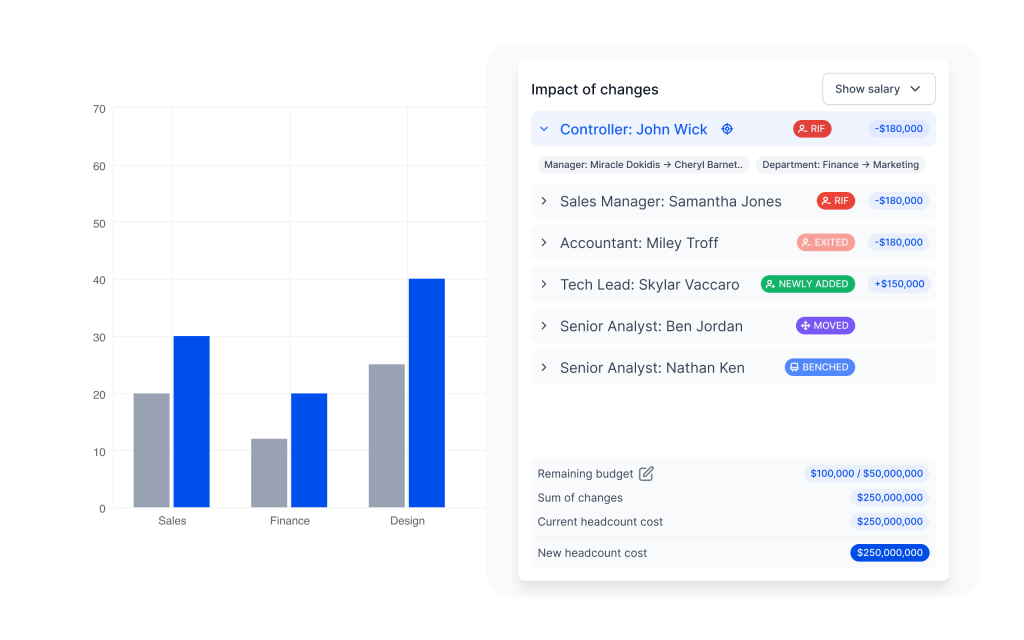

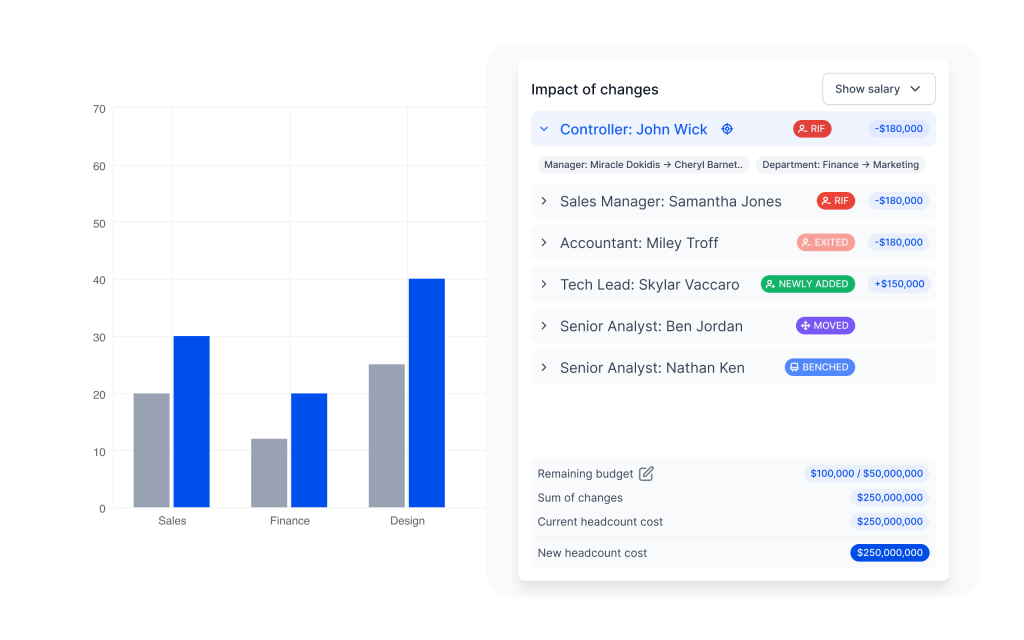

Model cost-saving scenarios

Simulate restructuring scenarios to visualize financial impact and optimize post-close workforce alignment.

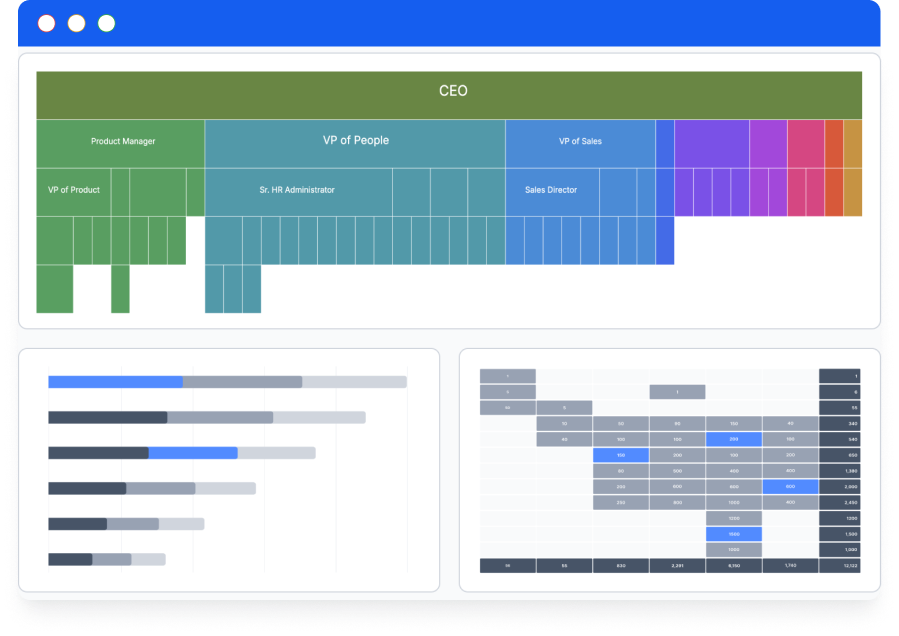

Benchmark and optimize people spend

Compare headcount structures, talent costs, and M&A synergies to align workforce strategies with financial goals.

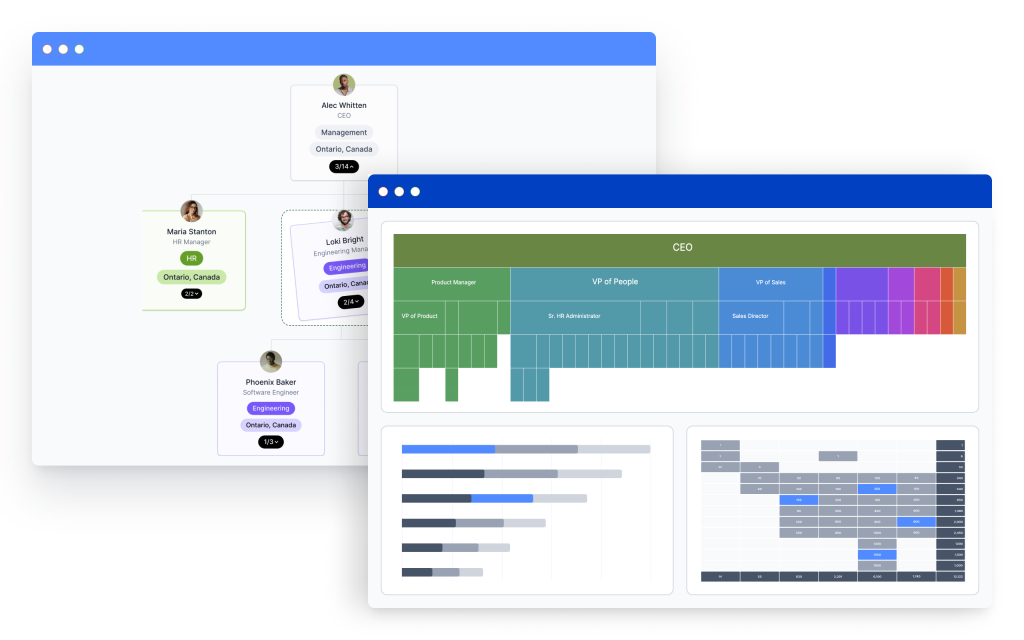

Understand

Understand your portfolio baseline and headcount and cost allocations

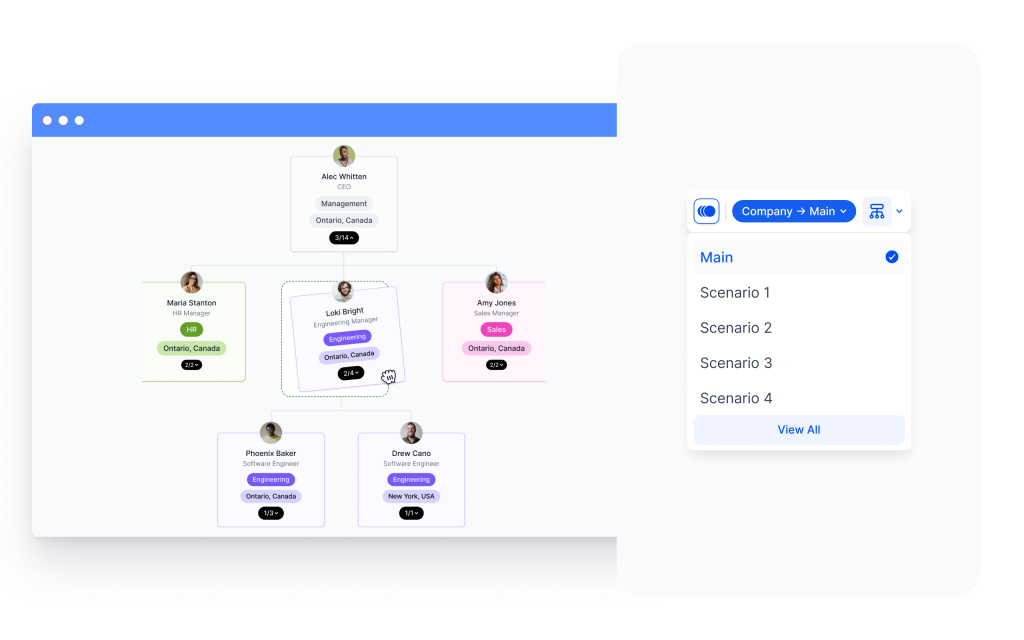

Model

Simulate what-if scenarios to optimize spend and drive value creation

Forecast

Assess financial and structural impacts and potential savings

Here's how it works

Here's how it works

Understand

Understand your portfolio baseline and headcount and cost allocations

Model

Simulate what-if scenarios to optimize spend and drive value creation

Forecast

Assess financial and structural impacts and potential savings

Agentnoon in 2 minutes

Visualize your team, model changes, and understand financial impacts - in seconds

Agentnoon helped us quickly understand headcount spend and cost allocations across all our portfolio companies quickly. We were able to benchmark portfolio variances and model changes to bring them in line with our planned benchmarks'

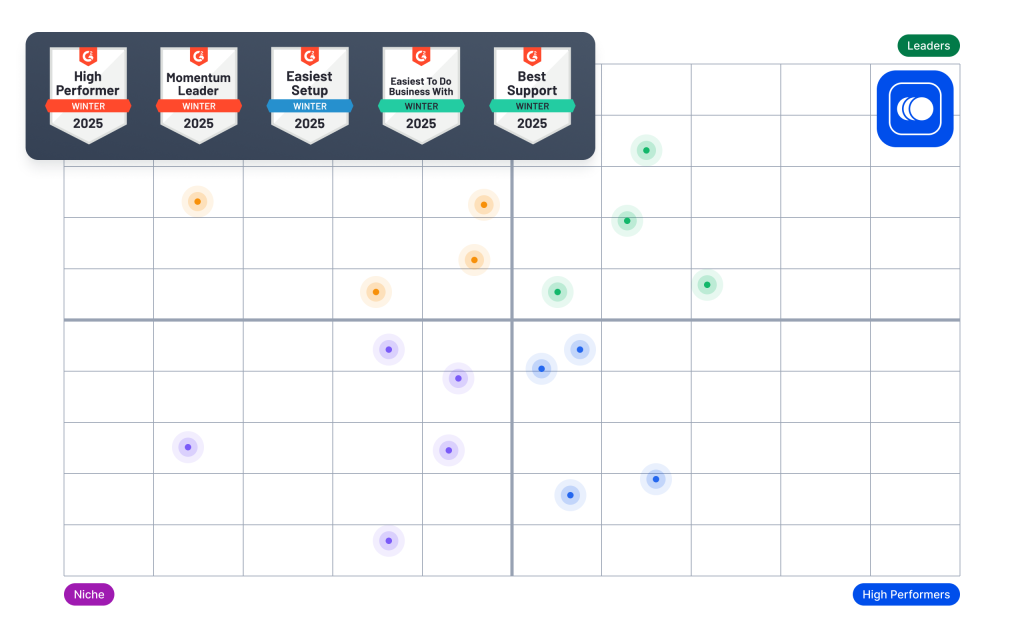

Market Momentum

Agentnoon is the market leader in org design

and transformation software

FAQs

PE firms need a centralized, data-driven approach to manage workforce costs, streamline planning, and maximize post-M&A value creation. Agentnoon delivers:

- Real-time workforce intelligence – Get a portfolio-wide view of headcount, costs, and inefficiencies to make data-backed decisions.

- AI-powered org modeling – Simulate workforce changes, assess financial impacts, and optimize structures before execution.

- Seamless M&A integration – Align leadership, eliminate redundancies, and accelerate post-close workforce restructuring for maximum synergy.

By replacing static spreadsheets with dynamic, real-time insights, Agentnoon helps PE firms cut costs, improve workforce efficiency, and drive higher returns across their portfolio.

Yes. Whether a PE firm is scaling emerging companies or improving operational efficiency in underperforming investments, Agentnoon adapts to diverse workforce planning needs:

- For high-growth companies:

Helps scale teams efficiently by forecasting talent needs and ensuring cost-effective workforce expansion. - For mature companies: Highlights opportunities for cost reduction, models layoffs or realignments, and ensures that downsizing doesn’t disrupt performance.

- For post-M&A integrations:

Identifies overlapping roles and team inefficiencies, ensuring workforce consolidation aligns with financial goals.

One of the biggest post-close challenges in M&A is workforce integration. Agentnoon helps PE firms:

- Simulate different workforce structures to test headcount synergies before implementation.

- Model cost-saving scenarios by visualizing potential layoffs, team consolidations, or leadership realignments.

- Accelerate integration planning by instantly assessing talent gaps, skill distributions, and compensation structures across companies.

- Track post-merger workforce performance to measure if the restructuring efforts align with expected synergies and cost reductions.

Yes. Agentnoon identifies opportunities to save costs without compromising operational effectiveness by:

- Detecting underutilized or misaligned roles that increase costs without adding value.

- Highlighting compensation disparities compared to benchmarks.

- Providing workforce scenario simulations that show cost savings before making personnel decisions.

- Helping reallocate human capital to maximize workforce efficiency across portfolio companies.

Yes! Agentnoon seamlessly integrates with 100+ HRIS and payroll systems, ensuring real-time, clean data across all portfolio companies.

Our Impact

Transform your organization. Become future ready.

The future of human capital value in private equity

Join top PE talent leaders exploring org design, workforce planning, and leadership transformation.

Proud sponsors of

The future of human capital value in private equity

Join top PE talent leaders exploring org design, workforce planning, and leadership transformation.

Proud sponsors of